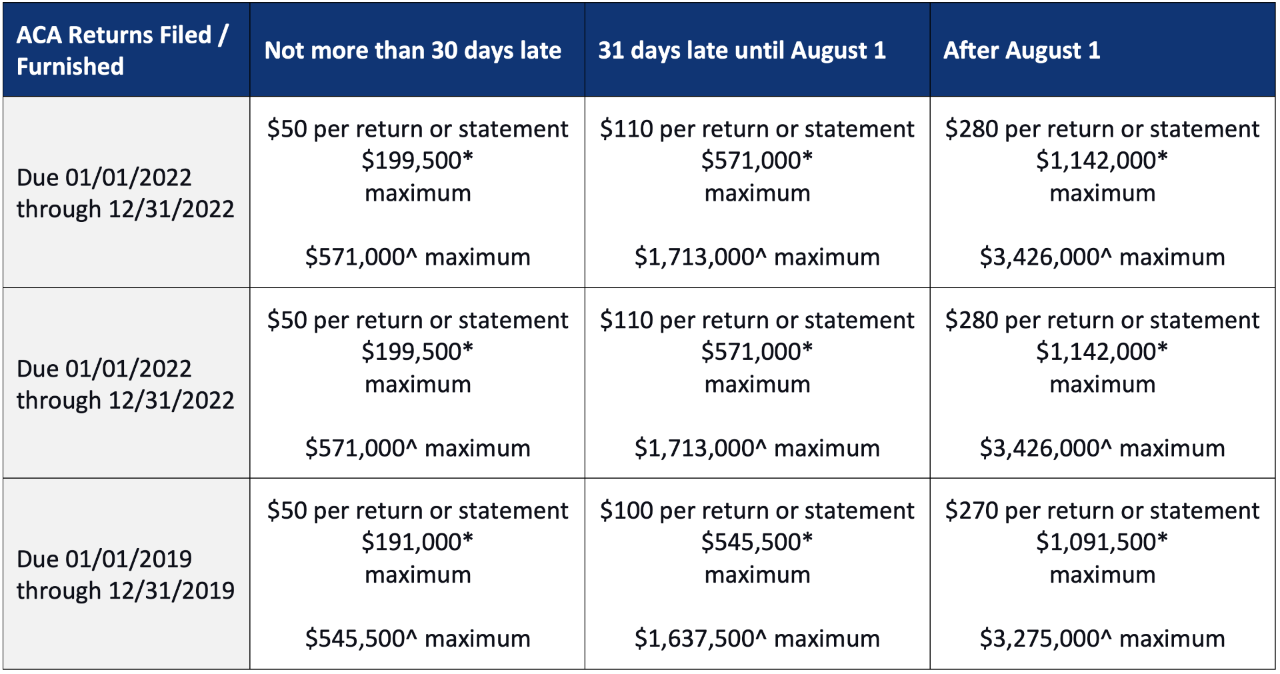

Beginning in 2021 (this year’s filing), all reporting must be accurate and timely. Corrections will require a letter of explanation and evidence to accompany each correction. The process will be significant, arduous, and time-consuming. Failure to adequately and accurately prove compliance, will result in a lengthy appeal process.

To Learn more about the ACA and the IRS plans to crack down in 2022, please contact:

Bryan Besco

Director of Business Development

UHY LLP

734-882-4608

bbesco@uhy-us.com